Increasing Revenue, For Billing Companies, For Practices

How do you measure patient collections?

For medical practices and billing companies striving to thrive financially, understanding what net patient collections are, which benchmarks matter most, and how to improve empowers healthcare leaders to optimize revenue cycle performance.

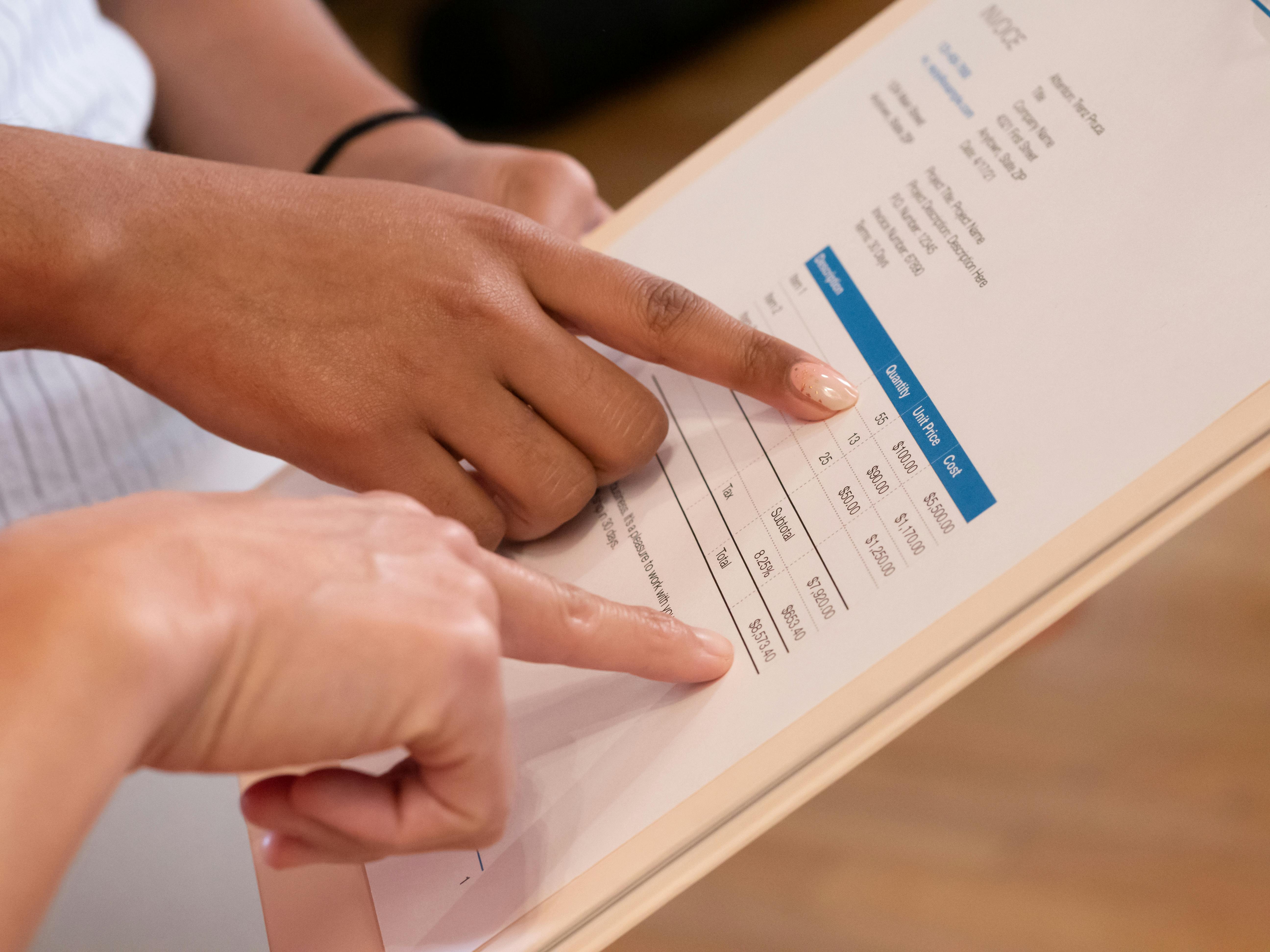

Defining patient collections: Patient collections is the process of collecting payment from patients for the portion of healthcare costs they are responsible for, such as copays, deductibles, coinsurance, and any remaining balances after insurance has paid. Today, patient payments make up a growing portion of a practice’s revenue, often up to 30%.

Net patient collections represent the actual dollars a practice collects after accounting for contractual adjustments with payers, write-offs, and other necessary deductions. Unlike gross collection figures, which can overstate what a practice could receive, net collections give a snapshot of cash actually realized from both patient and payer sources. This is why net collection rate — the percentage of collectible revenue a practice successfully collects — is often considered the best indicator of a practice’s true revenue cycle health.

Measuring patient collections goes beyond a single metric. Practices should track several benchmarks to gain a complete picture of how well they are converting services into collected revenue. These benchmarks include:

- Net patient collection rate tells you how much of your collectible revenue is being realized, offering insight into how effectively your practice engages patients in their financial responsibility.

- Days in accounts receivable (DAR) helps practices understand how long it takes to collect payments

- Bad debt ratios highlight the portion of revenue written off when accounts go uncollected. Together, these metrics create a dashboard that informs strategic decisions and highlights where revenue leakage may be occurring.

In practice, improving net patient collections requires both operational discipline and patient-centric communication. Best practices start before a patient ever walks through the door: clear financial conversations at scheduling and registration set expectations and reduce surprise. Verifying insurance eligibility and estimating patient responsibility ahead of time equip patients with clarity, helping them pay on time. Proactive communication continues after care: timely, transparent billing statements coupled with convenient payment options — like online portals, multiple payment methods, and flexible payment plans — remove friction and make it easier for patients to fulfill their obligations. Investing in technology to automate reminders, streamline billing workflows, and provide real-time visibility into collections performance can also significantly elevate collection outcomes. Training staff on compassionate yet effective financial conversations further improves patient trust and increases the likelihood of timely payment.

Ultimately, measuring and improving patient collections isn’t just about tightening the revenue cycle; it’s about building a practice that can weather shifts in payer behavior, regulatory changes, and evolving patient expectations. By focusing on net patient collections, tracking meaningful benchmarks, and adopting practices that make payment simple and clear for patients, medical practices unlock better financial performance and a more sustainable future.